Accounting and Bookkeeping

Bookkeeping and Accounting Services consist of preparing and maintaining the books of accounts on the regular periodical interval based on the client’s requirements. The businesses or individuals can consider referring to an outsourced accounting company that maintains the books of accounts. They use the latest and updated software such as Tally, Quick-book, and other cloud-based software.

What are Bookkeeping and Accounting

Bookkeeping is defined as the process of recording daily transactions of a business entity in a chronological way. Bookkeeping is a part of the accounting information system.

Accounting is an information system that includes recording processes, classifying, summarizing, reporting, analyzing, and interpreting the financial condition and performance of a business on a regular basis. It is helpful in communicating with stakeholders and considering their opinion in all the important business decision-making.

The professional team at Vaidya and Associates - a renowned accounting firm includes CA’s, accountants, and administrative staff who are well-equipped to handle all kinds of bookkeeping and accounting processes, from basic AR and AP entry, payment, and processing, to the more challenging duties of a CFO.

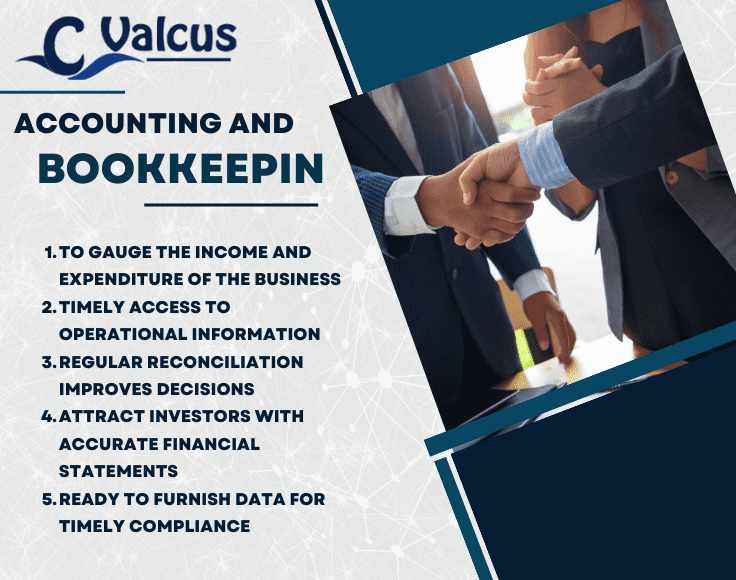

What are the Benefits of Accounting and Bookkeeping?

Accounting and Bookkeeping are known to provide several benefits to a businessman. No matter whether a business is small, medium or big, Accounting and Bookkeeping help in many ways. It is also necessary to comply with the law.

Some of the benefits of taking professional bookkeeping and accounting services include:

-

- To gauge the income and expenditure of the business

With the help of accounting services for small businesses, one can ensure smoothness and complete transparency in their day-to-day business activities. Whether you are an individual, firm, or corporation, it is important to know the income generated and expenditure incurred. With the help of bookkeeping and accounting, one can plan and strategize their financial resources and exploit them accordingly.

- Timely access to operational information

Updated records ensure easy accessibility to operational information and let management go through all the information at any point in time. Since business owners or other higher-level employees are not directly linked with all day-2-day transactions, keeping accounting and bookkeeping updated let them track all the activities.

- Regular reconciliation improves decisions

Monthly or weekly reconciliation of data lets the management make better decisions regarding the business. Accounting services come with the extra advantage of the periodical reconciliation of data. Hence, future decisions can be rationalized after analyzing the profit and loss.

- Attract investors with accurate financial statements

From an investment point of view also, maintaining a complete analysis of a business financial condition is important. While approaching investors, make sure that your books of accounts are accurate and updated as any kind of variation in financial statements might restrict investors from investing in your business.

- Ready to furnish data for timely compliance

With the help of accounting, one can easily extract data and submit it on time for regular return filing, compliance, and scrutiny of any business.

Documents Needed for Accounting and Bookkeeping Services

The list of documents required for Accounting and Bookkeeping Services includes:

- Company / Business Incorporation Documents

- Bank statement of a financial year/ monthly statement

- Purchase-Sales invoices, if any

- Expense bills, if any

- Any receivable and payable detail

- Any other Government registration taken

- Cash Expenses

- Bank Statement of partner/ members in case used for business works.

- Expenses made for company/ LLP registration by investors

About the Online Accounting Services

What are the benefits of taking Cloud-based for small businesses?

With the help of Cloud-based Accounting software or online Accounting Software, businesses can easily store and access data anytime through the internet. Some of the most common Cloud Accounting Systems used by Vaidya and Associates include QuickBooks Online, Xero, Zoho Books, etc. There are several advantages of using online accounting services for small businesses.

The advantages of using online accounting services for small businesses include:

Smooth Processing

Automation helps improve efficiency and saves time as well. Also, there are no or very less chances of errors.

Online Accessibility

Cloud-based accounting lets companies from across the world access the data. In simpler terms, cloud accounting software can easily be accessed from anywhere as it is wholly dependent on the internet.

Customize the Cloud as per your Needs:

With the help of online accounting services, one can alter cloud-based technologies to suit the personal needs of businesses. It helps all sorts of organizations in managing their accounting needs

Secure backup

The real-time access to data in an online way help creates a secure backup. Even in case the hardware crashes, the crucial data is available online and is safe and secure. All thanks to the professional online bookkeeping business.

Why Choose Vaidya and Associates?

Vaidya and Associates has years of experience in maintaining the books of accounts as per specific business requirements of the client. We completely understand the needs of our different clients and use the accounting system accordingly. We are experts in offering the best bookkeeping for small businesses, Accounting Services / Bookkeeping Services / Payroll Services as per the requirement of the client on a weekly, bi-weekly, monthly, quarterly, or yearly basis.

Our premium range of services includes all the aspects of maintenance of books of accounts including: -